Against this background of this trend, supplier management serves as an approach to guarantee an effective supply chain. One element of supplier management is supplier evaluation, which generates information for the selection of new suppliers and for the development of current suppliers. To keep the effort for a supplier evaluation low, companies in the automotive sector developed a standardized evaluation approach. For this development, Odette International and Automotive Industry Action Group (AIAG) worked strongly together. The approach had been published as ‘Global Materials Management Operations Guideline/Logistics Evaluation’ (in short: Global MMOG/LE), and is available in various languages as a tool for Microsoft Excel.

The objectives of the Global MMOG/LE are:

- “Produce a common SCM evaluation that can be used by all business partners, both internal and external.

- Establish the components of an SCM system for suppliers of goods and services within the automotive industry […].

- Enable SCM continual improvement plans to be developed and prioritized, thus enabling time to be spent on those activities that offer the greatest benefit.

- Provide a basis for benchmarking activities and identify ‘Best Practice Criteria’ of SCM processes for driving continual improvement plans.” (AIAG, Odette: GLOBAL MMOG/LE – Introduction and Instructions, 2014.)

- Strategy and improvement

- Work organization

- Capacity and production planning

- Customer interface

- Production and product control

- Supplier interface

- F1 criteria have the lowest importance. ‘Complying with F1 criteria contributes to the organization’s long-term sustainability and/or competitiveness.’ (AIAG, Odette: GLOBAL MMOG/LE – Introduction and Instructions, 2014.)

- ‘If an F2 criterion is not met, the organization’s performance and/or customer satisfaction may be seriously affected.’ (AIAG, Odette: GLOBAL MMOG/LE – Introduction and Instructions, 2014.)

- F3 criteria focus on fundamental requirements for business processes. ‘If an F3 criterion is not met, there is a high risk of interruption and/or incurring increased costs to the organization's and/or customer's operations.’ (AIAG, Odette: GLOBAL MMOG/LE – Introduction and Instructions, 2014.)

|

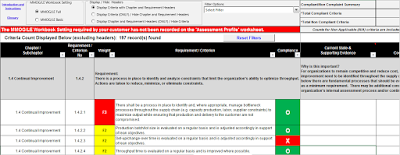

| Figure 1 – Global MMOG/LE’s assessment sheet (screenshot from the Microsoft Excel-based 'Global MMOG/LE') |

Figure 1 shows a screenshot of the assessment sheet of the Global MMOG/LE tool. It indicates the importance of the criteria by different colors (white, yellow, and red). It also shows met and unmet criteria by using green and red background color.

In chapter 2, you can find a sub-chapter, that explicitely deals with ‘risk assessment and management’. However, in each chapter one can identify questions that show a link to risk and risk management. But let’s look at chapter 2 first.

Table 1 lists criteria of sub-chapter 2.5, which explicitly focuses on risk assessment and management. The importance of risk management immediately becomes by realizing that 3 out of the 7 criteria are F3 criteria – and thus are essential for a company’s performance. One of the F3 criteria evaluates the existence of a process for risk assessment, the other two F3 criteria focus on emergency plans. It is important to note, that if any F3 criteria is not met, the supplier will automatically be ranked as a C supplier (the lowest and not achievable rank).

|

| Table 1: Risk-related criteria from sub-chapter 2.5 (source: AIAG, Odette: GLOBAL MMOG/LE, 2014) |

Beside sub-chapter 2.5, there are more criteria that explicitly or implicitly focus on risk and risk management. Some of those criteria are listed in table 2. Again one can realize that most of the criteria are of F2 or F3 type.

|

| Table 2: Selected further risk-related criteria (source: AIAG, Odette: GLOBAL MMOG/LE, 2014) |

Let us sum up the findings from using the Global MMOG/LE:

- The Global MMOG/LE had been developed as an industry-wide standard for logistics evaluations. This purpose is satisfied to a high degree.

- The structure of the catalogue of criteria is not intuitively understandable. For example, if it had followed the widely used SCOR model, there had been a better structured basis for the assessment. (See, for example, the post on using SCOR for risk management in the electronic industry in a post from November 2014.)

- Risk management is covered both explicitly and implicitly. On the one hand, there is sub-chapter 2.5, which lists seven criteria (three of them F3 criteria), that explicitly cover risk management topics. On the other hand, one can identify a large number of questions in other chapters, that also deal with risk and risk assessment.

- Global MMOG/LE does not explicitly identify risks. It rather lists criteria that should lead to an effective risk management.

A big ‚thank you‘ goes to Sascha Gröbel from the VDA for supporting this short article by giving me access to the Global MMOG/LE.

A longer version of this blog entry will be published (in German) in the upcoming book by Michael Huth and Frank Romeike: Risikomanagement in der Logistik: Konzepte – Instrumente – Anwendungsbeispiele, Springer 2015.